With a room full of data-hungry digital-first professionals at the TellyCast Digital Content Forum, Ampere Analysis principal analyst Hannah Walsh had a receptive audience for her company’s research into the evolving market landscape.

Walsh admitted that “the video industry has largely been an unpleasant place to exist in recent years” but looked to the future optimistically, with growth expected in sectors including ad-supported video on demand (AVOD) and particularly in social video.

“Having already seen 150% growth over the last five years, it’s due to grow another 50% by 2029,” she said of the latter category. Already in the UK, Brits are watching more social video on average than they are broadcast video-on-demand.

Ampere is tracking significant growth in engagement for YouTube and TikTok, and that’s based on surveys that only canvass people aged at least 18 – thus not including younger users who are likely using those platforms even more.

“Not only are Gen-Z using social media more frequently, but influencer videos are now the third most highly-ranked activity for that group,” she said, adding that watching games-related content is more popular for them than following traditional sports.

Cue the ever-increasing interest in digital-first content from the biggest companies in the broadcast world. “There’s a need to engage younger demographics if they want to grow audiences in the future,” said Walsh.

She also pointed to a parallel trend: that the broadcasters have gaps in their schedules that are increasingly being filled by shows that began as digital-first content, opening up another revenue stream for the studios and creators behind them.

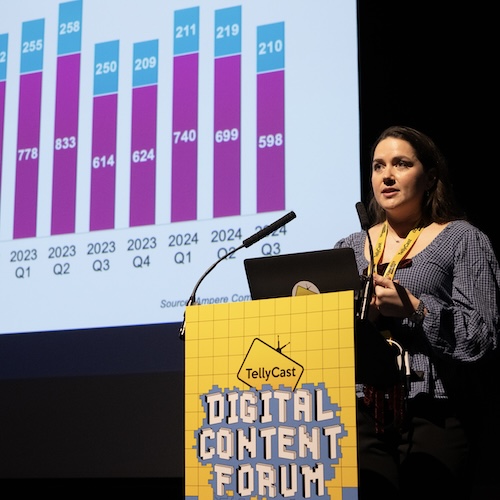

Walsh also looked at commissioning trends in the digital sector, noting that the peak of subscription video-on-demand commissions came in mid-2022, while “social media has plummeted over the past three years” in terms of platforms commissioning shows. That’s because the likes of YouTube and Snap have pulled back from big commissioning slates in favour of focusing more on their creators.

What’s being commissioned in the VoD world? It used to be dominated by scripted shows, but “we now see this equilibrium of scripted and unscripted,” said Walsh. As part of that shift, formats are taking a larger chunk of VoD commissions, and documentaries are on the rise too.

Walsh picked out some varied highlights showing the breadth of digital content strategies. Cobra Kai began as a YouTube Original, then moved to Netflix. Canal Quickie, meanwhile, is a live news and current affairs show broadcast on YouTube and Twitch, which then gets a delayed broadcast on terrestrial TV.

“I don’t think any of us would have seen that coming!” said Walsh. Her final example was Fail Army, which appears on more than 15 platforms including Amazon, DirecTV, Pluto TV, Samsung TV+ and Twitch. Another way of finding its way to audiences.

Finally, Walsh explained why it’s important for digital studios to try to hold on to their IP when cutting deals.

“You then have more say about the future windows of that content.. and you can also go down the line of creating merchandise for that show, and potentially creating your own subscription product too,” she said.